Clipper vs 0x Price Study

The Clipper team conducted a comprehensive quote comparison study to objectively assess the performance of Clipper and comparison to 0x, a software provider that aggregates and compares prices for crypto swaps. The study was designed to provide an empirical analysis of Clipper’s price performance in real-world trading scenarios.

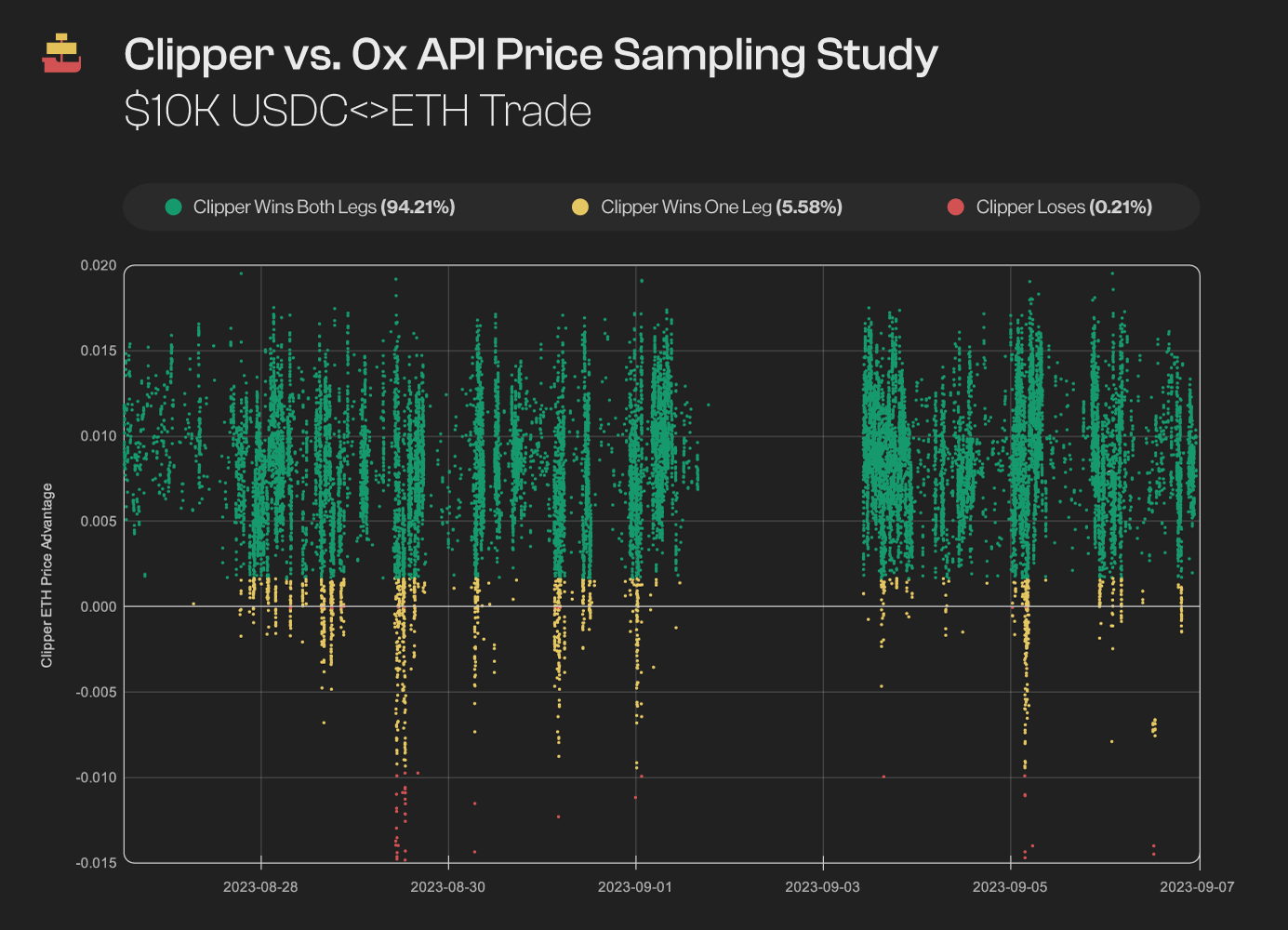

The study was conducted over two weeks - from 26-Aug to 08-Sep - with data collected at 15-minute intervals. In total the team analyzed 21,503 transactions.

Key Findings

Our analysis of the transactions revealed the following:

1. Clipper's Dominant Performance: Clipper outperformed 0x in the overwhelming majority of transactions, securing outright victory across both legs of a transaction 94.2% of the time (a leg is one direction of a swap, for example ETH->USDC is one leg while USDC->ETH is the second leg). Clipper won at least one leg of the transaction a further 5.6% of the time.

2. Clipper’s had a material gas advantage: Clipper is designed to be gas efficient, and uses roughly 15% less gas than Uniswap. To evaluate for this design difference the study considered whether Clipper would win a transaction with and without its Gas Delta. Because Clipper costs less gas.

Accounting for the gas delta, Clipper won swaps by a wider margin and marginally improved the number of swaps it won. Of the 21,503 Eth -> USDC transactions Clipper won without the Gas Delta 97.4% of the time and with the gas Delta 97.7% of the time.

3. Stochastic exceptions: In a small fraction of cases (0.21%), Clipper lost both legs to 0x. This is a normal variation that could happen for many reasons, most commonly when other DEXs are offering below-market prices that are likely losing money for LPs.

There was an error in the API during a short window of the study. The unavailablity of that data is reflected in the scatter plot above.

Methodology

Performance was measured directly through calls to the Clipper and 0x APIs. The study followed a structured four-step approach:

- Fetch Real-Time Data: The research team obtained current Ethereum (ETH) prices (denoted as 'e') and fast gas prices (denoted as 'g') to establish a baseline for the analysis.

- Calculate Effective Swap Return: The effective swap return, factoring in a 20,000 gas difference, was calculated for both USDC and ETH to assess transaction costs.

a. In USDC: Effective cost = g / 50

b. In ETH: Effective cost = g / (50 * e)

3. Compare USDC -> ETH Swaps

a. Fetch 10,000 USDC → ETH swap value from 0x API

b. Fetch 10,000 USDC → ETH swap value from Clipper API

c. Compare Clipper’s return value with and without the ETH gas delta calculated above (i.e., add the ETH gas delta value to Clipper’s ETH return).

4. Compare ETH -> USDC Swaps

a. Get $10,000 in ETH: 10,000/e.

b. Fetch 10,000/e ETH → USDC swap value from 0x API

c. Fetch 10,000/e ETH → USDC swap value from Clipper API

Conclusion

Clipper’s quote comparison study provides an objective view of Clipper's performance in blue-chip cryptocurrency trading when compared to 0x. With a strong overall success rate of 99.79%, Clipper demonstrated its efficiency and cost-effectiveness in facilitating crypto swaps. These findings offer valuable insights for investors and traders seeking reliable platforms for their cryptocurrency transactions.

**Disclaimer: The information presented in this study is based on data collected during the study period and should be considered alongside other relevant factors when making a decision to use Clipper.**