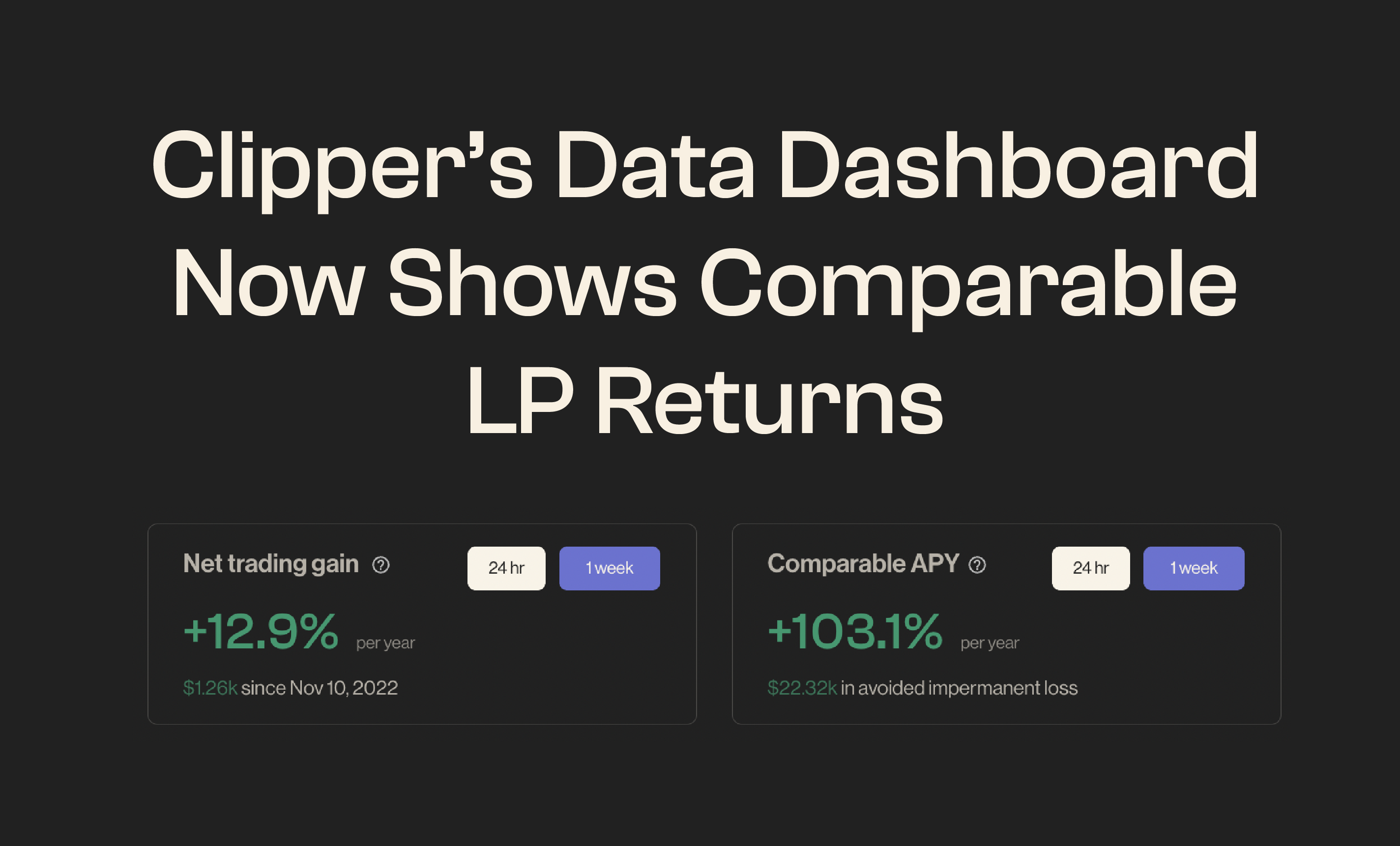

Clipper’s Data Dashboard Now Shows Comparable LP Returns!

LPs: Ever wonder how much impermanent loss you’re avoiding by being a liquidity provider on Clipper versus other DEXs like Uniswap? Well, Clipper’s data dashboard now includes a feature that shows you exactly that!

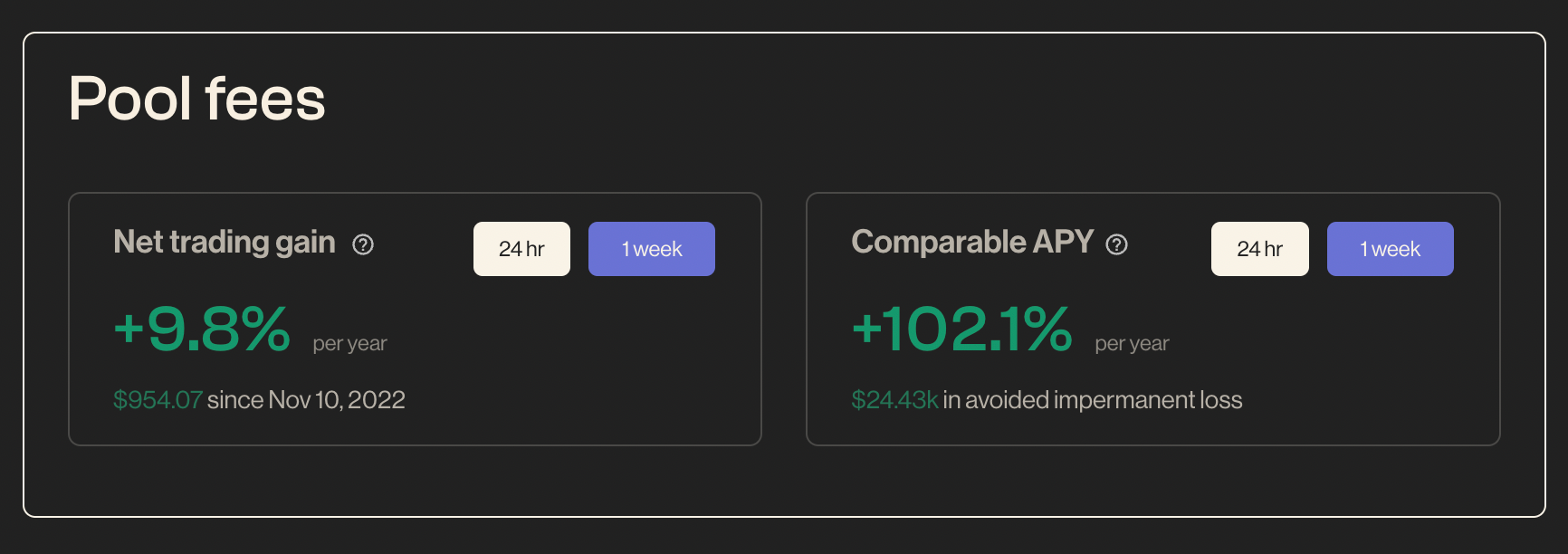

The dashboard’s newest metric, Comparable APY, shows the yield for Clipper’s core pools on Ethereum, Polygon, and Optimism including the impermanent loss (IL) LPs avoid thanks to Clipper’s novel FMM design. These APYs are directly comparable to the APYs reported by other DEXs, such as Uniswap and Sushi. The tracker also shows (under the Comparable APY figure) the total dollar amount of IL that has been avoided by Clipper LPs. The sum of the Net Trading Gain and Comparable APY dollar figures will give you the comparable fees for the period.

True, Profit-Based APY

When it comes to LP returns, APYs quoted by the vast majority of DEXs can be misleading. In traditional finance, annual percentage yield (APY) refers to one’s profit over the course of a year, expressed as a return on their capital. However, most DEXs don’t subtract the costs LPs may incur while providing liquidity (like IL) from their APY figures. This means the “APY” these DEXs quote is really top-line revenue, not bottom-line profit, and the yield LPs actually take home is likely lower than these APY figures indicate. For further information on Profit Yield, see Shipyard’s past blog posts on Profit Yield as a new DeFi standard and our methodology for calculating it.

Because Clipper’s pools do not experience impermanent loss, the Net Trading Gain (Profit Yield) quoted on the data dashboard is the true annualized profit Clipper LPs have sailed home with.

How Does Clipper Avoid Impermanent Loss?

There’s a common misconception that IL is wholly unavoidable in DEX liquidity pools. This misconception stems from the fact that most DEXs today utilize a type of AMM called a constant product market maker (CPMM). CPMMs are inherently prone to impermanent loss because of the way they balance liquidity pool assets. Impermanent loss is a real risk that, despite its name, can have lasting and detrimental effects on LP returns.

More specifically, tokens on CPMM-based DEXs are priced by a constant function. Impermanent loss is caused by arbitrageurs exploiting discrepancies between these prices and external market prices. This activity is what keeps CPMM prices in line with the rest of the market, but the profit arbitrageurs extract is siphoned from LP holdings. LPs realize this loss if upon withdrawing their stake from the pool, the value of the assets they retrieve is lower (at current market prices) than if they had simply held them. It’s possible for the observed losses to be “impermanent” if the price divergence is reversed before the LP’s withdrawal, but there’s no guarantee that will happen (and it often doesn’t). The real return for LPs is a balance between impermanent loss and accumulated yields, which is why an accurate APY must factor in IL.

This risk can be avoided, however, by utilizing an alternative AMM design. Clipper’s Formula Market Maker (FMM) design circumvents impermanent loss with a pricing function that uses external market prices from decentralized oracles as well as token ratios in pools to balance assets, instead of the constant function CPMMs use. The addition of price oracles makes it so that when external market prices change, Clipper’s prices update without the need for arbitrage trading. Clipper’s deliberately small pool sizes also work to deter arbitrageurs while the oracles update and its bot-blocking technology stops them altogether.

That doesn’t mean that Clipper is always profitable; all yield-generating opportunities come with a degree of risk. Clipper tracks the rebalancing portfolio you may have learned about in Modern Portfolio Theory. This portfolio provides optimal risk-adjusted beta exposure while generating free alpha from volatility along the way. It’s the approach that won a Nobel Prize in 1990.

With the addition of the Comparable APY metric to Clipper’s data dashboard, LPs get an accurate picture not only of the real profit they can expect but also of how much yield Clipper’s FMM design saves them in impermanent loss. Clipper is designed to provide the best possible swap prices for self-made crypto traders, and in order to make that happen it’s crucial to provide the most transparent and accurate information to Clipper LPs so they can make the right decisions for themselves.