Commodity Volatility Harvesting & Clipper’s Benchmark

Bitcoin and Ethereum are commodities like gold and oil. A typical feature of commodities is that they experience high volatility over weeklong periods and their prices tend to be mean reverting. What does this convey? When the price of a commodity gets very high, it tends to draw out supply, thus lowering the price. Conversely, when the price drops very low, it tends to restrict supply, thus increasing the price. As a result, commodity prices move frequently and have a fairly predictable pattern. This combination of high volatility and mean reversion suggests an opportunity for investors to potentially capture excess return by “harvesting” this volatility. Portfolio rebalancing is one strategy designed to harvest volatility.

What is Rebalancing?

Rebalancing is the act of adjusting a diversified portfolio’s asset allocations to match the target allocations and risk tolerance level. Rebalancing is necessary because asset prices do not move in lockstep, and so initial allocations will change over time. For example, many financial advisors recommend a classic personal portfolio of 60% stocks and 40% bonds. If stocks rise 10% in value and bonds fall 10%, the portfolio allocations become ~ 65%/35%. This portfolio can be rebalanced by selling stocks to buy bonds until the 60%/40% target composition is restored.

How Rebalancing Stacks Up

In a mean-reverting environment, a rebalancing portfolio can outperform a static (”held”) portfolio consisting of any initial combination of the assets themselves. This is because it is equivalent to systematically “buying low and selling high”. As long as there is sufficiently more short-term volatility relative to long-term volatility, rebalancing harvests additional profits. For example, imagine a two-asset portfolio consisting of a risky asset and a stablecoin. On day one, the risky asset doubles in price. On day two the risky asset returns to its original value. It can be verified that a 50-50 rebalanced portfolio will return 1.125x, vs. 1x for simply holding any combination of assets for the two days.

Crypto Prices Have Become More Mean Reverting As They Have Matured

Asset prices can either show momentum, be memoryless, or be mean reverting. Momentum is when asset prices continue to move in the same direction. Memoryless is when each subsequent price movement in a series cannot be predicted from the previous one (i.e., independent events). Mean reverting is when asset prices tend to revert back toward their mean or average following spikes. Rebalancing works in environments that are either memoryless or mean reverting, but makes the most sense in mean reverting regimes.

In order to verify if crypto prices are indeed mean reverting, we ran a statistical test called the Hurst Exponent on the price movements of ETH from late 2015 through May of this year. The Hurst Exponent provided us with a scalar value from which we could identify if the price series is mean reverting, memoryless, or momentum driven. In a memoryless price series, variance over 90-day windows should be 3x the variance at the 30-day window. A momentum price series will be above 3, and a mean reverting series will be below 3 (check out this article for more on the calculations involved in this test).

As can be seen below, from mid-2018 onward, ETH has typically been either memoryless or mean reverting, whereas prior to that it was noticeably momentum driven.

This verifies that ETH prices seem to be more mean reverting as it has matured, making it a prime candidate for rebalancing.

Rebalancing Frequency

Now that we have determined that crypto is a good candidate for rebalancing, the question becomes: how often should rebalancing occur for optimal results? Theoretically, the answer is as frequently as possible. However, in practice, rebalancing is usually done on a quarterly or even an annual basis (this is true for both TradFi and DeFi portfolios). Why? because every rebalancing event incurs transaction costs. Absent a special situation, transaction costs are usually proportional to transaction volume. Transaction volume is proportional to daily volatility which, as we’ve said, is expected to be much higher than longer-term volatility. Because of this, transaction costs tend to eat up any gains from frequent rebalancing, which is why investment portfolios typically rebalance at a slower cadence.

Clipper’s Costless Daily Rebalancing Portfolio

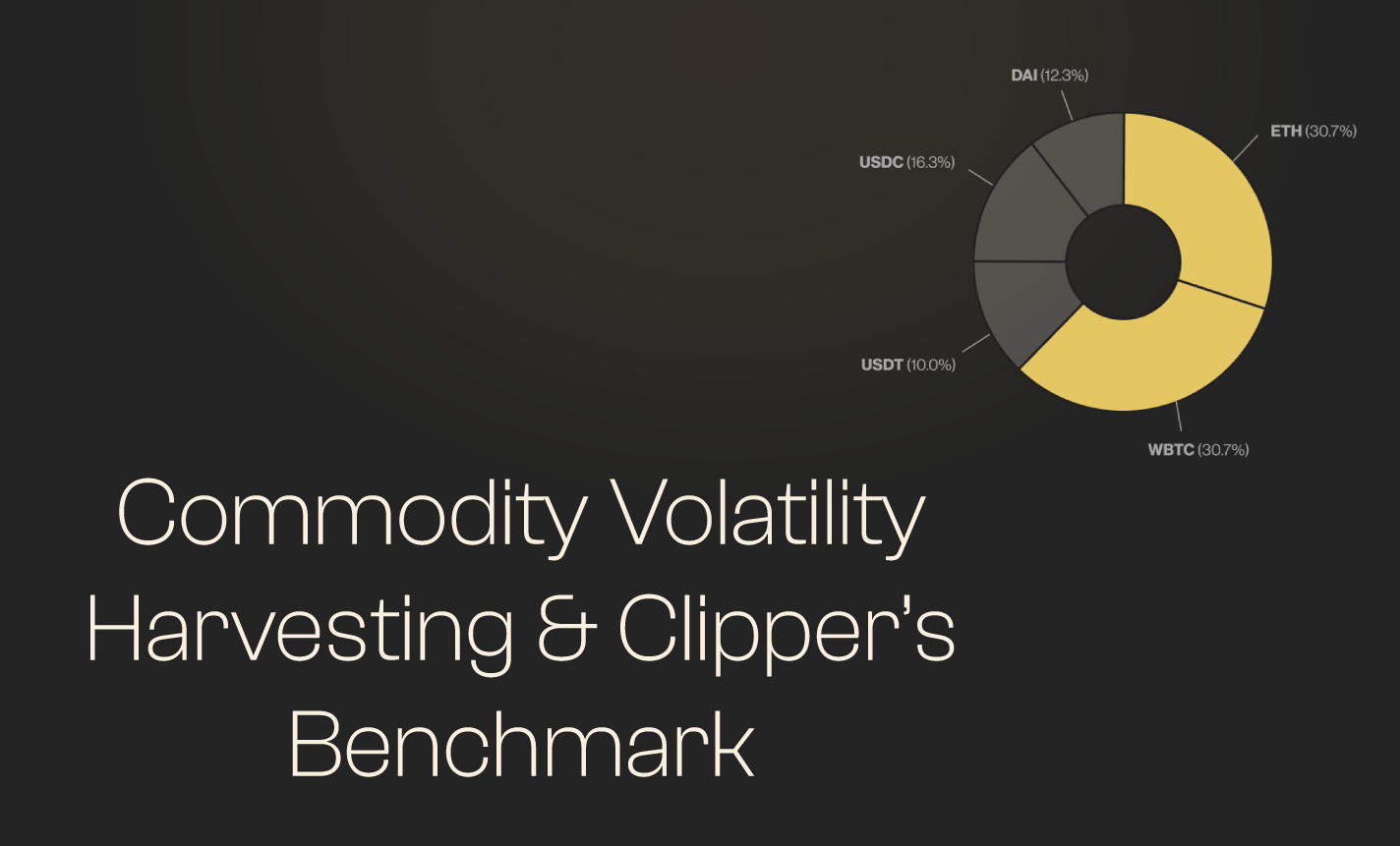

Clipper tracks a costless theoretical daily rebalancing portfolio composed of 60% ETH-BTC and 40% stablecoins. This benchmark is analogous to the “standard” 60-40 stocks-bonds portfolio recommended for individuals by many financial advisors.

However, this benchmark is not practically achievable, and real-world attempts to track it (e.g., with a derivative) would carry a hefty fee premium. The benchmark is in and of itself impossible to hit because is it costless. This means that anyone trying to track it starts at a disadvantage. Clipper achieves this benchmark by facilitating swaps at advantageous prices with the noisy order flow from retail traders. This noisy flow is ensured by only transacting with human traders; deterring over-informed whales and banning bots. Because Clipper maintains smaller liquidity pools, volume turns over extremely fast—sometimes multiple times per week. This means Clipper can quickly rebalance its pools simply by using organic trade flow. This is how Clipper is able to capture excess yield in its liquidity pools, providing superior returns for liquidity providers.