What is Clipper?

A DEX Built for Retail Traders

Clipper is a decentralized exchange custom-designed to give traders the lowest per-transaction costs (including fees, slippage, and gas) on trades under $50k.

The vast majority of DEXs are structured in a way that prioritizes high dollar trading volume above all else. In practice, this model generates profit-scalping opportunities for bots and arbitrageurs, often to the detriment of retail traders. These exchanges were built to serve everyone, but their emphasis on volume makes it so that their benefits only actually accrue to big traders like whales, hedge funds, and market makers. Clipper is the antithesis of this approach.

Clipper’s design is contrary to that of most DEXs in several ways. The most significant is that Clipper utilizes a unique Automated Market Maker (AMM) mechanism called the Formula Market Maker (FMM), rather than the Constant Product Market Maker (CPMM) used by most DEXs. Clipper also implements various design trade-offs that sacrifice price competitiveness on large trades for better prices on smaller trades. These differences in design make it so that Clipper is able to provide users with the best possible prices on small trades and superior LP yields without any impermanent loss!

Formula Market Maker

As we know, computing resources are extremely expensive on Ethereum mainnet (at one point gas fees on a single Uniswap transaction was over $50!). Because of this, the first generation of AMMs, like the one used in Uniswap, needed a pricing formula that was as simple as possible in order to keep computing resources (and thus gas fees) down. The simplest viable pricing formula was the CPMM model (x*y = k), so that’s what Uniswap used. However, while its simplicity is nice, it has a fatal flaw: it’s a terrible trading strategy for LPs because it loses money if prices move at all from their origin (creating so-called “impermanent loss”). This explains why CPMM-based protocols charge traders a fee on every transaction instead of charging LPs a percentage on gains. It also explains why CPMM-based DEXs publish LP fees, but not actual LP profits; because their LP returns are typically negative.

Clipper’s FMM uses a more complex pricing formula than the CPMM. Of course, this increased complexity requires more processing power. To avoid using more gas, Clipper relies on off-chain servers to process its formula and generate quotes for traders. The pool then verifies and validates the formula on-chain to prevent any malicious quotes, which requires very little processing and thus very little gas. This architecture allows for complex pricing formulas that are actually profitable for LPs while keeping gas costs low (if not lower than the CPMM).

Best Prices on Small Trades

Although it may seem counterintuitive, large liquidity pools can be bad for retail traders. Most DEXs want as much liquidity as possible in their pools because more liquidity = less slippage. However, after a certain point, more liquidity doesn't have any material benefit for small trades; it only continues to reduce slippage on large trades. E.g., the slippage on a $1k trade is virtually the same in a $100m liquidity pool as it is in a $1B liquidity pool (see for yourself). More liquidity can actually be counterproductive because the more liquidity there is in a pool, the higher the fees traders must pay in order for the pool to maintain that liquidity level. Capital always expects a return; the more capital LPs provide to a pool, the more yield they must be paid. With AMMs, fees are typically charged on every trade and primarily go to cover the cost of capital from LPs. Therefore, a liquidity pool’s TVL has a direct impact on trader fees. Generally, smaller pools can incur lower fees but have more slippage and larger pools have higher fees but less slippage.

One of the design trade-offs Clipper makes is maintaining smaller liquidity pools. Clipper sustains TVL levels in its pools that achieve an optimal balance of fees and slippage for small trades. Because there is less capital in Clipper’s pools, trading fees are low but still sufficient enough to provide appropriate LP yields to maintain liquidity levels. Smaller pools mean there is more slippage on Clipper, but for small trades, the decrease in fees offsets the increased slippage. On the other hand, slippage on large trades outweighs the decrease in trading fees, making Clipper a bad place for whales and arbitrageurs.

Uniquely Structured Liquidity Pools

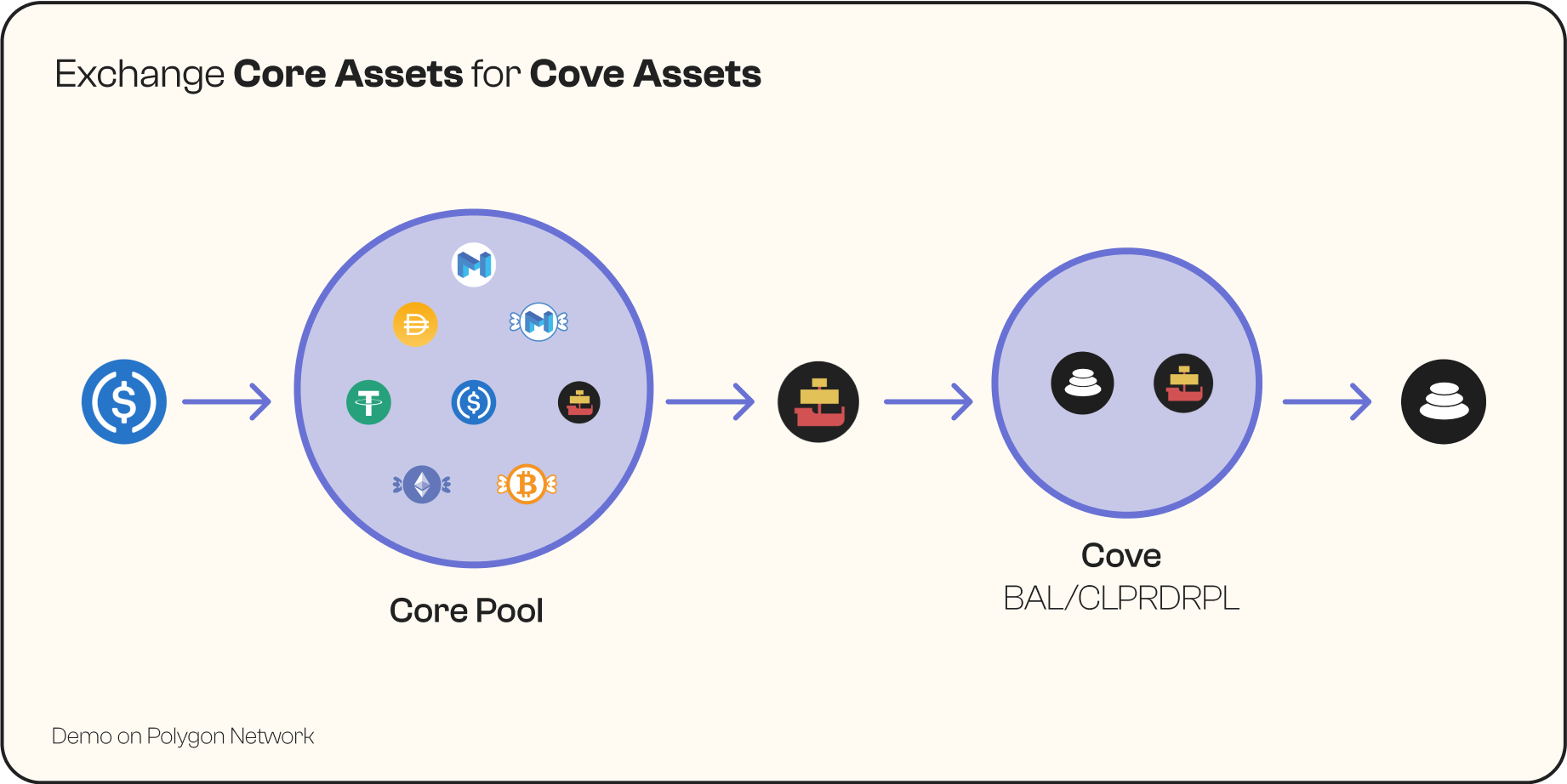

Clipper has two unique structures for providing liquidity and collecting yield: Core Pools and Coves.

Core Pools are multi-asset liquidity pools composed of Core Assets (usually ETH, WBTC, USDC, USDT, DAI, MATIC/OP). These are assets that comprise 80% of all trade volume in DeFi.

Core pools are maintained at the ideal volume for small trades. Pools can be used to trade Core Assets (e.g., ETH → USDC) or to LP and earn yield. Unlike most DEX liquidity pools, Clipper LPs earn yield on a pro-rata portion of the entire pool, not just the asset(s) they deposit. Upon depositing, LPs receive LP tokens called CLPRDRPL, which represent their fractional ownership of the underlying pool. CLPRDRPL tokens have no value other than as represented in the given pool. There is one Core Pool on each chain. The benefit of using one unified pool is to consolidate liquidity, rather than fragmenting it across multiple pools to achieve the same pairings. This increases capital efficiency, allowing for higher yields with lower fees. Currently supported chains for Core Pools are Ethereum, Polygon, Optimism, and Arbitrum.

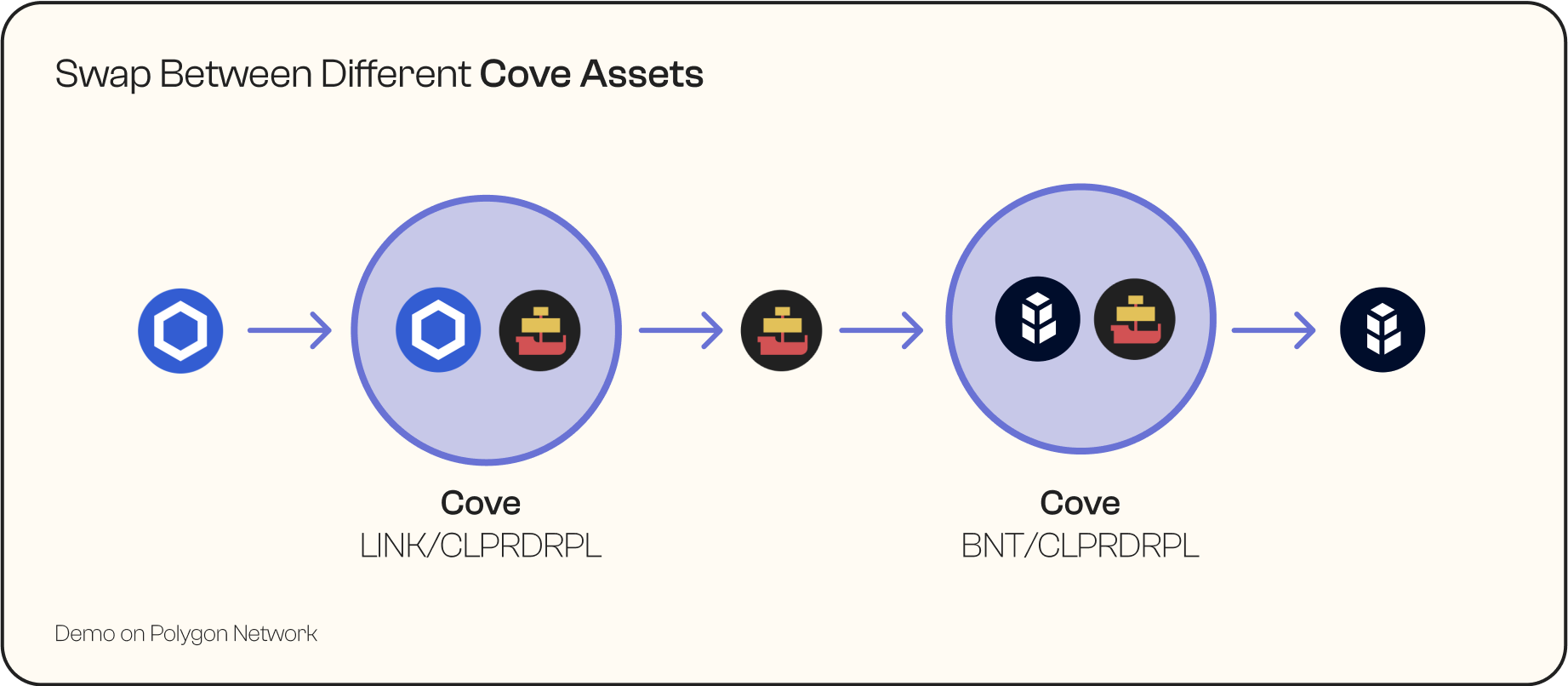

Clipper Coves are an ecosystem of liquidity pools (each pool is a Cove) that enable swaps between different asset pairs. Whereas in Core Pools traders can only swap between Core Assets, Coves enable swaps between any asset pair.

How Coves work: Each Cove is a two-asset pool made up of a Cove Asset and CLPRDRPL tokens. Cove Assets are any and all altcoins/tokens that aren’t a Clipper Core Asset, e.g., LINK, AAVE, BNT, etc. Traders can create new Coves for any tokens they want. The CLPRDRPL tokens in Coves are mainly used on the backend as a “go-between” that enables very low trading costs when swapping assets. This means traders never actually see these tokens while interacting with Coves unless they are providing liquidity.

Coves can be used to swap between different Cove Assets (e.g., LINK → BNT) or between Core Assets and Cove Assets and vice-versa (e.g., USDC ← → BAL). They can also be used to LP and earn double yield, i.e., from both the Cove Asset and the CLPRDRPL in the cove. Currently supported chains for Coves are Polygon, Optimism, and Arbitrum.

No Impermanent Loss for LPs!

There’s a big misconception that impermanent loss (IL) is an unavoidable feature of DEX liquidity pools. The misconception came about because most DEXs today utilize a CPMM and CPMMs are inherently prone to IL due to how they balance liquidity pool assets. Tokens on CPMM-based DEXs are priced by a constant function and IL is caused by arbitrageurs exploiting discrepancies between the prices set by the CPMM and external market prices. While arbitrage activity keeps CPMM prices in line with the rest of the market, the profit arbitrageurs extract is siphoned from LP holdings. Despite its name, impermanent loss is a real risk that can have lasting and detrimental effects on LP returns. LPs realize this loss if upon withdrawing their stake from the pool, the value of the assets they retrieve is lower (at current market prices) than if they had simply held them.

Impermanent loss can be avoided by not using a CPMM. Clipper’s FMM design employs a pricing function that uses both external, up-to-the-second market prices from decentralized oracles and token ratios in pools to balance assets, instead of a constant function. The price oracles make it so that when external market prices change, Clipper’s prices update without the need for arbitrage trade. Clipper’s small liquidity pool sizes also work to deter arbitrageurs while the oracles update and bot-blocking technology stops them altogether.

Better Yields Than CPMM DEXs

Clipper’s liquidity pools were designed with modern portfolio theory in mind and built to track the benchmark of a theoretical zero-cost Daily Rebalancing Portfolio (DRP). With a DRP, LPs have diversified exposure to a group of assets with varying levels of risk, minimizing their risk exposure (also known as maximizing the Sharpe Ratio). The DRP has a well-documented attribute of earning money from volatility and it substantially outperforms the CPMM (see above link for details). Below is a comparison of the different AMM types used in DEXs.

Unlike CPMM-based DEXs, Clipper does not have explicit fees nor impermanent loss. Rather, trade prices are chosen to move the pool closer to the DRP, which simply accrues value in the pool. This makes it difficult to compare Clipper’s bottom-line LP figures with the top-line revenue numbers most other DEXs use. To ensure full transparency and keep LPs informed, Clipper reports comparable metrics and historical earnings on the Clipper data dashboard.

These metrics include

- Profit Yield: the sum of the positive difference between Clipper input and output on swaps, according to on-chain price oracles. This figure reflects Clipper LPs' total gains over the given period.

- Comparable APY: top-line yield that includes the impermanent loss avoided by Clipper’s FMM design. These APYs are directly comparable with the APYs reported by most other DEXs (like Uniswap and Sushi), which advertise inflated figures that don't account for hidden costs.

- Avoided Impermanent Loss: calculated by comparing Clipper LPs' gain or loss on a crypto-basis (as opposed to a USD basis) to the crypto-basis loss of the CPMM mechanism used by Uniswap, etc. This crypto-basis loss can be calculated from (and will change based on) the difference in dollar values of the assets at the start and end of the given period.